Thursday, December 31, 2009

Tuesday, December 29, 2009

Wednesday, December 23, 2009

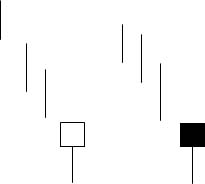

Belajar Candlestick: The Shooting Star

Description

The Shooting Star is comprised of one candle. It is easily identified by the presence of a small body with a shadow at least two times greater than the body. It is found at the top of an uptrend. The Japanese named this pattern because it looks like a shooting star falling from the sky with the tail trailing it.

Criteria

- The upper shadow should be at least two times the length of the body.

- The real body is at the lower end of the trading range. The color of the body is not important although a black body should have slightly more bearish implications.

- There should be no lower shadow or a very small lower shadow.

- The following day needs to confirm the Shooting Star signal with a black candle or better yet, a gap down with a lower close.

Signal Enhancements

- The longer the upper shadow, the higher the potential of a reversal occurring.

- A gap up from the previous day's close sets up for a stronger reversal move provided.

- The day after the Shooting Star signal opens lower.

- Large volume on the Shooting Star day increases the chances that a blow-off day has occurred although it is not a necessity.

After a strong up-trend has been in effect, the atmosphere is bullish. The price opens and trades higher. The bulls are in control. But before the end of the day, the bears step in and take the price back down to the lower end of the trading range, creating a small body for the day. This could indicate that the bulls still have control if analyzing a Western bar chart. However, the long upper shadow represents that sellers had started stepping in at these levels. Even though the bulls may have been able to keep the price positive by the end of the day, the evidence of the selling was apparent. A lower open or a black candle the next day reinforces the fact that selling is going on.

source: candlestickforum

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, December 16, 2009

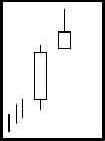

Belajar Candlestick: Hammers and Hanging Man

Description

The Hammer is comprised of one candle. It is easily identified by the presence of a small body with a shadow at least two times greater than the body. Found at the bottom of a downtrend, this shows evidence that the bulls started to step in. The color of the small body is not important but a white candle has slightly more bullish implications than the black body. A positive day is required the following day to confirm this signal.

Criteria

- The lower shadow should be at least two times the length of the body.

- The real body is at the upper end of the trading range. The color of the body is not important although a white body should have slightly more bullish implications.

- There should be no upper shadow or a very small upper shadow.

- The following day needs to confirm the Hammer signal with a strong bullish

day.

Signal Enhancements

- The longer the lower shadow, the higher the potential of a reversal occurring.

- A gap down from the previous day's close sets up for a stronger reversal move provided the day after the Hammer signal opens higher.

- Large volume on the Hammer day increases the chances that a blow off day has occurred.

Pattern Psychology

After a downtrend has been in effect, the atmosphere is very bearish. The price opens and starts to trade lower. The bears are still in control. The bulls then step in. They start bringing the price back up towards the top of the trading range. This creates a small body with a large lower shadow. This represents that the bears could not maintain control. The long lower shadow now has the bears questioning whether the decline is still intact. A higher open the next day would confirm that the bulls had taken control.

source: candlestickforum

Analisa Saham Indonesia: Signal Sell dari SGRO

Saham SGRO

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Monday, December 14, 2009

Analisa Saham Indonesia: Signal Buy dari DOID

Saham DOID

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Friday, December 11, 2009

Ayo....naiklah POLY!!!

Saham POLY

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Tuesday, December 08, 2009

Thursday, December 03, 2009

Beli BBRI lagi yuk....

Saham BBRI

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, November 25, 2009

Signal SELL dari BMRI

Saham BMRI

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Monday, November 23, 2009

Signal Sell dari Saham CPIN

Baca postingan saya tentang saham CPIN disini

Pada penutupan Jumat (20/11), muncul signal sell. Silahkan dicermati.

.Apakah ini hanya merupakan false signal? Kita lihat saja pada hari Senin besok (23/11).

Pada penutupan Jumat (20/11), muncul signal sell. Silahkan dicermati.

Saham CPIN

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Thursday, November 19, 2009

Beli Saham BNBR dan ITTG lagi ah........

Saham BNBR

Saham ITTG

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Cermati Saham DEWA

Saham DEWA

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Tuesday, November 17, 2009

Signal BUY dari INDF, ANTM dan TINS

Saham INDF

Saham ANTM

Saham TINS

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Monday, November 16, 2009

Saatnya Beli BUMI

Saham BUMI

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Friday, November 13, 2009

BBNI Buy

Saham BNI

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Monday, November 09, 2009

Hati-hati, BBRI ada Gap!!!

Saham BBRI

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Friday, November 06, 2009

Buy TLKM!!!

Analisa Saham TLKM

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, November 04, 2009

Analisa Saham ITMG

Analisa Saham ITMG

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Friday, October 30, 2009

Saham Bumi naik 3,13%, rebound atau...?

Kemarin (29/10) atau dini hari tadi, Dow naik 2,05% dan Bumi naik +3,13% ke 2.475.

Bagaimana dengan hari Jumat (30/10) ini?

Sebagai acuan lihat chart saham BUMI dibawah ini.

MACD masih dibawah signalnya, RSI menjauhi batas oversold dan stochastik %K masih dibawah stochastic %D dengan range lebar.

Bagaimana dengan hari Jumat (30/10) ini?

Sebagai acuan lihat chart saham BUMI dibawah ini.

Analisa saham BUMI

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Thursday, October 29, 2009

IHSG? Crash jilid berapa sekarang ya...?

Harga penutupan IHSG kemarin (28/10) turun 2,88% ke level 2355,31. Para analis memperkirakan turunnya indeks IHSG pada semua sektor pada hari itu mengalami penurunan yang cukup signifikan akibat panic selling karena kekhawatiran para investor akan kondisi saham-saham pertambanagan menyusul harga minyak dunia yang kembali volitile. Sementara Dow Jones pada hari kemarin juga merosot 119.48 poin atau 1.21% ke level 9,762.69; S&P 500 anjlok 20.78 poin atau 1.95% ke level 1,042.63; dan Nasdaq terjun 56.48 poin atau 2.67%, ke level 2,059.61

Dari scan yang saya lakukan untuk harga penutupan kemarin (28/10) hampir tidak ada saham yang memunculkan signal buy, kebanyakan memunculkan signal sell atau saham-saham yang sebelumnya telah muncul signal sell, untuk melanjutkan down trend nya.

Bagaimana dengan perdagangan hari ini, dengan melihat kondisi indeks Dow turun? Kita saksikan yang berikut ini....he..he..he...

Dari scan yang saya lakukan untuk harga penutupan kemarin (28/10) hampir tidak ada saham yang memunculkan signal buy, kebanyakan memunculkan signal sell atau saham-saham yang sebelumnya telah muncul signal sell, untuk melanjutkan down trend nya.

Bagaimana dengan perdagangan hari ini, dengan melihat kondisi indeks Dow turun? Kita saksikan yang berikut ini....he..he..he...

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, October 28, 2009

Analisa Saham TINS, ANTM dan INDF: muncul signal sell pada 27 Okt 2009

Berikut pilihan saham Indonesia untuk perdagangan hari Rabu, 28 Oktober 2009:

Analisa Saham TINS

Analisa ANTM

Analisa Saham INDF

Namun semua ini balik lagi pada kondisi/isu-isu baik dari pasar domestik maupun regional.

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Tuesday, October 27, 2009

Indikator dalam Technical Analysis

Technical Analysis (analisa teknikal) dalam pasar saham maupun forex telah berkembang sejak lama dan menjadi ilmu yang kompleks serta diteliti dan dikembangkan secara terus-menerus. Penelitian dan pengembangan ini sudah mulai lebih dari ratusan tahun yang lalu dengan diperkenalkannya pertama kali indeks DOW. Sekarang analisa teknikal telah mencakup berbagai macam indikator teknis yang bisa digunakan di pasar yang berbeda, dimana dengan indikator teknis ini dapat menjelaskan berbagai perilaku harga dan volume, analisis volatilitas, psikologi trading dan lain sebagainya.

Jika ratusan tahun yang lalu DOW indeks hanya digunakan untuk menganalisis pasar dan melihat tren pasar secara umum, sekarang, dengan revolusi dalam teknologi informasi, kita memiliki berbagai macam indikator teknis untuk menganalisis pasar. Saat ini, juga dikembangkan suatu sistem perdagangan berdasarkan beberapa indikator teknis - yakni sistem trading yang memungkinkan mengotomatisasi proses pembuatan keputusan trading tanpa memasukkan faktor emosional dari trading tsb. Pertanyaannya adalah berapa banyak dan indikator apa yang harus digunakan dalam analisa pasar? Tidak ada jawaban pasti dari pertanyaan ini. Pemilihan indikator tergantung pada banyak faktor salah satunya adalah gaya trading dan pengetahuan tentang pasar tsb. Namun, ada rekomendasi yang dapat dipertanggung jawabkan yang bisa digunakan oleh setiap trader.

1. Gunakan indikator teknis yang sudah familiar dengan Anda dan sudah sering di gunakan. Jika Anda trader pemula maka Anda bisa mulai dari yang sederhana lebih dahulu kemudian pindah ke indikator yang lebih rumit. Pergerakan harga rata-rata (Price Moving Average) dan pergerakan volume rata-rata (Volume Moving Average) adalah dua indikator dasar yang bisa digunakan dan sebagai landasan untuk penggunaan indikator teknis lainnya yang lebih kompleks.

2. Trend harga suatu saham selalu digambarkan dari perubahan harga dan volume (jumlah saham) yang diperdagangkan selama perubahan harga tsb. Oleh karena itu adalah logis untuk memiliki setidaknya satu indikator teknis berdasarkan harga dan volume tsb. Sebagai salah satu aturan dalam analisa teknikal adalah "tidak ada perubahan harga tanpa volume dan tidak ada volume tanpa pergerakan harga ".

3. Indikator dapat berguna untuk monitoring pergerakan harga suatu saham dan volatilitas pasar. Analis profesional tahu bahwa pasar berperilaku berbeda di saat pasar Bull dan Bear, dimana titik resistance-nya dimana titik support-nya dan sistem trading harus selalu disesuaikan agar dapat bereaksi saat pembalikan arah trend. Tergantung pada pengetahuan dan data yang dimiliki, bisa menggunakan VIX (indeks volatilitas), ATR (Average True Range) atau indikator volatilitas lainnya.

Itu adalah tiga aturan dasar yang mungkin bisa digunakan untuk setiap trader, terutama trader yang baru pertama kali dalam analisa teknis.

Jika ratusan tahun yang lalu DOW indeks hanya digunakan untuk menganalisis pasar dan melihat tren pasar secara umum, sekarang, dengan revolusi dalam teknologi informasi, kita memiliki berbagai macam indikator teknis untuk menganalisis pasar. Saat ini, juga dikembangkan suatu sistem perdagangan berdasarkan beberapa indikator teknis - yakni sistem trading yang memungkinkan mengotomatisasi proses pembuatan keputusan trading tanpa memasukkan faktor emosional dari trading tsb. Pertanyaannya adalah berapa banyak dan indikator apa yang harus digunakan dalam analisa pasar? Tidak ada jawaban pasti dari pertanyaan ini. Pemilihan indikator tergantung pada banyak faktor salah satunya adalah gaya trading dan pengetahuan tentang pasar tsb. Namun, ada rekomendasi yang dapat dipertanggung jawabkan yang bisa digunakan oleh setiap trader.

1. Gunakan indikator teknis yang sudah familiar dengan Anda dan sudah sering di gunakan. Jika Anda trader pemula maka Anda bisa mulai dari yang sederhana lebih dahulu kemudian pindah ke indikator yang lebih rumit. Pergerakan harga rata-rata (Price Moving Average) dan pergerakan volume rata-rata (Volume Moving Average) adalah dua indikator dasar yang bisa digunakan dan sebagai landasan untuk penggunaan indikator teknis lainnya yang lebih kompleks.

2. Trend harga suatu saham selalu digambarkan dari perubahan harga dan volume (jumlah saham) yang diperdagangkan selama perubahan harga tsb. Oleh karena itu adalah logis untuk memiliki setidaknya satu indikator teknis berdasarkan harga dan volume tsb. Sebagai salah satu aturan dalam analisa teknikal adalah "tidak ada perubahan harga tanpa volume dan tidak ada volume tanpa pergerakan harga ".

3. Indikator dapat berguna untuk monitoring pergerakan harga suatu saham dan volatilitas pasar. Analis profesional tahu bahwa pasar berperilaku berbeda di saat pasar Bull dan Bear, dimana titik resistance-nya dimana titik support-nya dan sistem trading harus selalu disesuaikan agar dapat bereaksi saat pembalikan arah trend. Tergantung pada pengetahuan dan data yang dimiliki, bisa menggunakan VIX (indeks volatilitas), ATR (Average True Range) atau indikator volatilitas lainnya.

Itu adalah tiga aturan dasar yang mungkin bisa digunakan untuk setiap trader, terutama trader yang baru pertama kali dalam analisa teknis.

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Thursday, October 22, 2009

Analisa Saham Indonesia BNBR

Analisa saham Indonesia kali ini mengulas saham BNBR. Sejak 18/8 RSI (15) sudah memotong batas 70 (overbought) dari atas menuju netral yang mengindikasikan pergerakannya sideway. Namun pada hari kemarin 21/10 sudah muncul signal sell lagi. Akankah pergerakan harganya akan menuju Fibo 61.8% (110-109) hari ini atau di hari-hari selanjutnya?

Indikator yang mendukung adalah MACD dibawah Signalnya, kemudian RSI(15) berada di area netral serta Stochastic %K masih berada dibawah %D.

Indikator yang mendukung adalah MACD dibawah Signalnya, kemudian RSI(15) berada di area netral serta Stochastic %K masih berada dibawah %D.

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, October 21, 2009

Mastering Psychology Can Make You Rich

You should never underestimate the importance of psychology when it comes to trading the various markets. Many traders believe they will become a master of trading by reading a book. Others by acquiring or developing some magical indicator or system. The truth of the matter is that it takes years of proper trading education along with experience to become a good trader. Some people do become good traders after putting in the time. The key to becoming a great trader is to master the psychology of trading.

The force behind psychology in the marketplace is human emotion. Fear, greed and hope are human emotions that have taken down many traders. A good example would be the emotion of "hope". Let’s say you bought xyz stock. Your xyz stock starts to go against you. The best thing you can do is get out of the stock, taking a small, manageable loss. But you keep watching your stock go lower and lower with the "hope" it will turn around. The emotion of "hope" just caused you a massive loss. The key is to eliminate all emotion when trading the markets. How is this accomplished?

First of all, you need a good sound trading plan to follow. Following your trading plan which includes solid money management is a great start. Then you need to change your way of thinking, modify your behavior. The best traders think differently from the rest. That's why they are great traders. You need to think in terms of "probabilities" once you have an edge in the market because of your sound trading plan. Winning trading doesn't have anything to do with being right or wrong on any particular trade because all trades have an uncertain outcome. You will be able to make a fortune over time because of your edge. Concentrate on the process, not the results. The results will take care of themselves.

The world's best traders and investors can put on a trade without hesitating or having to worry about it. They also can easily admit the trade isn't working and exit with a small loss. They don't let fear rule them, but at the same time, they are not reckless. You must always remember that each trade has an uncertain outcome with the odds in your favor. This is your trading edge. Your attitude is key to winning at nearly everything in life.

The force behind psychology in the marketplace is human emotion. Fear, greed and hope are human emotions that have taken down many traders. A good example would be the emotion of "hope". Let’s say you bought xyz stock. Your xyz stock starts to go against you. The best thing you can do is get out of the stock, taking a small, manageable loss. But you keep watching your stock go lower and lower with the "hope" it will turn around. The emotion of "hope" just caused you a massive loss. The key is to eliminate all emotion when trading the markets. How is this accomplished?

First of all, you need a good sound trading plan to follow. Following your trading plan which includes solid money management is a great start. Then you need to change your way of thinking, modify your behavior. The best traders think differently from the rest. That's why they are great traders. You need to think in terms of "probabilities" once you have an edge in the market because of your sound trading plan. Winning trading doesn't have anything to do with being right or wrong on any particular trade because all trades have an uncertain outcome. You will be able to make a fortune over time because of your edge. Concentrate on the process, not the results. The results will take care of themselves.

The world's best traders and investors can put on a trade without hesitating or having to worry about it. They also can easily admit the trade isn't working and exit with a small loss. They don't let fear rule them, but at the same time, they are not reckless. You must always remember that each trade has an uncertain outcome with the odds in your favor. This is your trading edge. Your attitude is key to winning at nearly everything in life.

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Sunday, October 18, 2009

Analisa Saham BRPT

Saham Indonesia kali ini akan mengetengahkan analisa saham BRPT. Analisa saham ini berdasarkan indikator sederhana yakni menggunakan indikator SAR, MACD dan Stochastic. Sejak 31/8 harga saham BRPT berkonsolidasi antara range 1.445 - 1.620.

Pada harga penutupan Jumat (16/10) telah muncul signal Buy dengan didukung oleh signal SAR Buy juga (detail lihat gambar dibawah). Mampukah pada senin esok (19/10) harga saham BRPT menembus range 1.620 tsb? Kita lihat.

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Thursday, October 15, 2009

Moving Averages Analysis

Moving average is one of the basic and most popular indicators in technical analysis

. From the name of this indicator you may already understand that this indicator shows the average price of a security (stock, option, bond, etc) over specified period of time or specified period of bars. There are two most used types of moving average: Simple Moving Average (short name SMA) and Exponential Moving Average (short name EMA). The difference between simple and exponential moving averages is that exponential one uses weighing factors to reduce the lag in simple MA.

The purpose of moving average is to smooth shorter-term price fluctuation within the longer-term trend in order to define the direction of the current longer-term trend. This technical indicator is one of the oldest in technical analysis

and is considered as trend following indicator or a lagging indicator. Price moving averages themselves do not predict coming trend reversals but rather follow the changes in the trend. However, smoothing factor they use allows to filter small price changes and alert when the price-trend change has become critical to consider opening/closing a position.

Moving Averages are widely used in different trading systems to confirm trend as well as generate conservative longer-term trading signals. Over the last several decades technicians have build the number of other technical indicators based on the moving averages which help traders to define price volatility (example could be Standard Deviation indicator), recognize trend direction (as an example - MACD), as a signal line (for instance TRIX with Signal Line) and to smooth other technical indicators such as volume, advances and declines.

MACD and MACD Histogram are one of the most popular technical indicators calculations of which are based on the Moving Averages. In technical analysis MACD is considered as momentum indicator and is used to show the relation between fast (smaller bar period) and slow (bigger bar period) moving averages. This is a simple technical indicator that calculates the difference between two exponential moving averages by oscillating around zero line (center line).

PPO (Percentage Price Oscillator) is another technical indicator that is very similar to MACD. Percentage Price Oscillator is calculated as ration between two moving averages (between fast and slow). It is analyzed and used in the same way MACD is used with the difference that it oscillates around 1 while MACD moves around 0.

Both MACD and PPO reveal the direction of the shorter term trend (fast MA) in relation to the longer term trend (slow MA) and used to generate trading signals from divergence, moving average crossovers and centerline crossovers.

src: http://www.articlebase.com

. From the name of this indicator you may already understand that this indicator shows the average price of a security (stock, option, bond, etc) over specified period of time or specified period of bars. There are two most used types of moving average: Simple Moving Average (short name SMA) and Exponential Moving Average (short name EMA). The difference between simple and exponential moving averages is that exponential one uses weighing factors to reduce the lag in simple MA.

The purpose of moving average is to smooth shorter-term price fluctuation within the longer-term trend in order to define the direction of the current longer-term trend. This technical indicator is one of the oldest in technical analysis

and is considered as trend following indicator or a lagging indicator. Price moving averages themselves do not predict coming trend reversals but rather follow the changes in the trend. However, smoothing factor they use allows to filter small price changes and alert when the price-trend change has become critical to consider opening/closing a position.

Moving Averages are widely used in different trading systems to confirm trend as well as generate conservative longer-term trading signals. Over the last several decades technicians have build the number of other technical indicators based on the moving averages which help traders to define price volatility (example could be Standard Deviation indicator), recognize trend direction (as an example - MACD), as a signal line (for instance TRIX with Signal Line) and to smooth other technical indicators such as volume, advances and declines.

MACD and MACD Histogram are one of the most popular technical indicators calculations of which are based on the Moving Averages. In technical analysis MACD is considered as momentum indicator and is used to show the relation between fast (smaller bar period) and slow (bigger bar period) moving averages. This is a simple technical indicator that calculates the difference between two exponential moving averages by oscillating around zero line (center line).

PPO (Percentage Price Oscillator) is another technical indicator that is very similar to MACD. Percentage Price Oscillator is calculated as ration between two moving averages (between fast and slow). It is analyzed and used in the same way MACD is used with the difference that it oscillates around 1 while MACD moves around 0.

Both MACD and PPO reveal the direction of the shorter term trend (fast MA) in relation to the longer term trend (slow MA) and used to generate trading signals from divergence, moving average crossovers and centerline crossovers.

src: http://www.articlebase.com

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, October 14, 2009

Analisa Saham ITTG

Berikut Analisa Saham ITTG dari Saham Indonesia:

Coba lihat lagi postingan saya tentang ITTG disini. Dan perhatikan chart ITTG hari ini, signal Sell telah muncul sejak 13/10 dimana harga penutupan dibawah harga MA Swing (366) dan hari ini (14/10) juga harga penutupan masih dibawah harga MA Swing (363). Saatnya ITTG memasuki masa down trend.

Analisa saham ITTG

Coba lihat lagi postingan saya tentang ITTG disini. Dan perhatikan chart ITTG hari ini, signal Sell telah muncul sejak 13/10 dimana harga penutupan dibawah harga MA Swing (366) dan hari ini (14/10) juga harga penutupan masih dibawah harga MA Swing (363). Saatnya ITTG memasuki masa down trend.

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Sunday, October 11, 2009

Sell PLAS dan ITMG!!!

Berikut Analisa saham dari Saham Indonesia:

Analisa Saham PLAS:

- Mulai muncul tanda signal sell, dimana harga penutupan pada JUmat (9/10) 1.370 berada dibawah MA Swing (1.492)

- Signal SAR Sell sudah muncul sejak 8/10.

- Namun demikian perpotongan antara RSI dan EMA belum terjadi.

Analisa Saham PLAS

Analisa Saham ITMG:

- Signal Sell sudah muncul, dimana harga penutupan Jumat (9/10) 23.250 berada dibawah MA Swing (24.512).

- Didukung juga oleh telah terjadinya perpotongan RSI dan EMA serta stochastic fast (lihat gambar).

Analisa Saham ITMG

Analisa Saham PLAS:

- Mulai muncul tanda signal sell, dimana harga penutupan pada JUmat (9/10) 1.370 berada dibawah MA Swing (1.492)

- Signal SAR Sell sudah muncul sejak 8/10.

- Namun demikian perpotongan antara RSI dan EMA belum terjadi.

Analisa Saham ITMG:

- Signal Sell sudah muncul, dimana harga penutupan Jumat (9/10) 23.250 berada dibawah MA Swing (24.512).

- Didukung juga oleh telah terjadinya perpotongan RSI dan EMA serta stochastic fast (lihat gambar).

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Wednesday, October 07, 2009

Asian Markets End Higher On Optimism About Recovery

The major Asian markets open for trading continued its northward march and ended higher on increasing optimism that the world economy is on the recovery path. Higher commodity prices amid weaker dollar and increasing optimism about better corporate results acted as positive catalysts.

In Japan, the benchmark Nikkei 225 Index gained 107.80 points, or 1.11% to 9,800, while the broader Topix index of all first section stocks was up 14.06 points, or 1.61%, to 886.

In Australia, the benchmark S&P/ASX200 Index surged up 104.10 points, or 2.27% to close at 4,696, while the All-Ordinaries Index ended at 4,696, representing a gain of 98.60 points, or 2.14%.

In South Korea, the KOSPI Index ended flat with a marginal drop of 0.44 points, or 0.03% at 1,598 as the gains in commodity related stocks was more than offset by drop in technology and automotive stocks. Traders preferred to lock in gains in the technology and automotive stocks following dollar weakness, while optimism about recovery prospects lifted the commodity related stocks. Volume was relatively moderate amid volatile trading. While the major gainers were Posco Steel and Korea Zinc, the top losers were the automotive stocks and technology stocks.

Among the other major markets in the region, Indonesia's Jakarta Composite Index slipped 14.74 points, or 0.58% and ended lower at 2,513. However, Taiwan's Weighted Index gained 72.61 points, or 0.96% to close at 7,609, and Singapore's Strait Times Index added 22.74 points, or 0.87%, to close at 2,635. The market in Shanghai is closed for national holidays.

source: www.advfn.com

In Japan, the benchmark Nikkei 225 Index gained 107.80 points, or 1.11% to 9,800, while the broader Topix index of all first section stocks was up 14.06 points, or 1.61%, to 886.

In Australia, the benchmark S&P/ASX200 Index surged up 104.10 points, or 2.27% to close at 4,696, while the All-Ordinaries Index ended at 4,696, representing a gain of 98.60 points, or 2.14%.

In South Korea, the KOSPI Index ended flat with a marginal drop of 0.44 points, or 0.03% at 1,598 as the gains in commodity related stocks was more than offset by drop in technology and automotive stocks. Traders preferred to lock in gains in the technology and automotive stocks following dollar weakness, while optimism about recovery prospects lifted the commodity related stocks. Volume was relatively moderate amid volatile trading. While the major gainers were Posco Steel and Korea Zinc, the top losers were the automotive stocks and technology stocks.

Among the other major markets in the region, Indonesia's Jakarta Composite Index slipped 14.74 points, or 0.58% and ended lower at 2,513. However, Taiwan's Weighted Index gained 72.61 points, or 0.96% to close at 7,609, and Singapore's Strait Times Index added 22.74 points, or 0.87%, to close at 2,635. The market in Shanghai is closed for national holidays.

source: www.advfn.com

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Monday, October 05, 2009

Analisa Saham SGRO, JECC dan DGIK

Masih trend naik (silahkan diakumulasi) --> SMCB.

Saham Indonesia | Analisa Saham | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Sunday, October 04, 2009

Analisa saham UNSP, KARK dan CPIN

Berikut analisa saham Indonesia:

SELL: UNSP

BUY: KARK dan CPIN

Analisa Saham | Saham Indonesia | Analisa Saham Indonesia | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Monday, September 28, 2009

Analisa Saham BUMI dan ITMG - saatnya untuk Sell

Saham Indonesia | Analisa Saham BUMI ITMG | Analisa Saham Indonesia BUMI ITMG | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Sunday, September 27, 2009

Anlisa Saham SDRA - Hold

Bagi yang masih megang saham SDRA....masih aman!!!

Saham Indonesia SDRA | Analisa Saham SDRA | Analisa Saham Indonesia SDRA | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Analisa Saham PGAS dan INCO - saatnya untuk Sell

Saham Indonesia PGAS INCO | Analisa Saham PGAS INCO | Analisa Saham Indonesia PGAS INCO | Belajar Analisa Saham

Belajar Analisa Saham Indonesia | Sharing knowledge to bring forward the Indonesia Stock Market

Friday, September 25, 2009

Sell SMRA

Pada 15/09 didahului dengan terjadinya perpotongan stochastic yang kemudian pada 24/09 dikuatkan dengan kemunculan signal sell dari MSA Trading System.

SMRA

Mari kita lihat kelanjutannya...

Mari kita lihat kelanjutannya...

Subscribe to:

Comments (Atom)