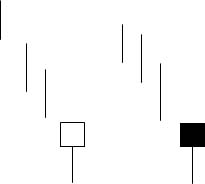

Description

The Hammer is comprised of one candle. It is easily identified by the presence of a small body with a shadow at least two times greater than the body. Found at the bottom of a downtrend, this shows evidence that the bulls started to step in. The color of the small body is not important but a white candle has slightly more bullish implications than the black body. A positive day is required the following day to confirm this signal.

Criteria

- The lower shadow should be at least two times the length of the body.

- The real body is at the upper end of the trading range. The color of the body is not important although a white body should have slightly more bullish implications.

- There should be no upper shadow or a very small upper shadow.

- The following day needs to confirm the Hammer signal with a strong bullish

day.

Signal Enhancements

- The longer the lower shadow, the higher the potential of a reversal occurring.

- A gap down from the previous day's close sets up for a stronger reversal move provided the day after the Hammer signal opens higher.

- Large volume on the Hammer day increases the chances that a blow off day has occurred.

Pattern Psychology

After a downtrend has been in effect, the atmosphere is very bearish. The price opens and starts to trade lower. The bears are still in control. The bulls then step in. They start bringing the price back up towards the top of the trading range. This creates a small body with a large lower shadow. This represents that the bears could not maintain control. The long lower shadow now has the bears questioning whether the decline is still intact. A higher open the next day would confirm that the bulls had taken control.

source: candlestickforum

1 komentar:

OK thanks for your information

Post a Comment